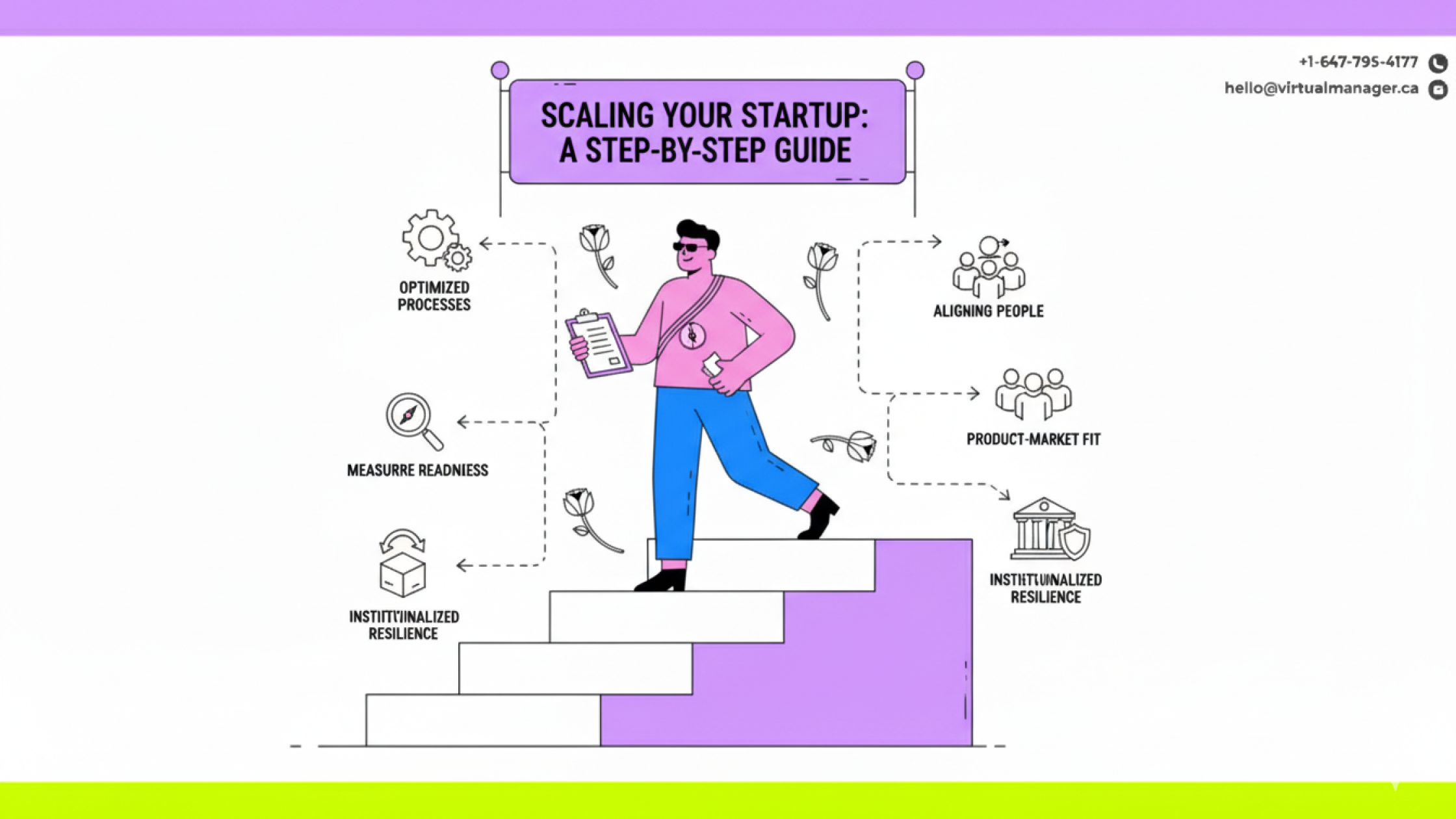

Many founders push for rapid expansion only to see systems fail, and you need a clear roadmap to avoid those pitfalls; this guide shows how scaling your startup step-by-step aligns product, people, and processes so you grow without collapsing, with actionable frameworks to help you measure readiness, prioritize investments, and institutionalize resilience while you scale your startup sustainably.

Discovering Your Product’s True Value — Accelerate scaling your startup

Identifying Pain Points in the Market (for scaling your startup)

Map your customer journey using qualitative interviews and quantitative signals: analyze 200–500 support tickets, churn reasons, and session recordings to spot friction points; prioritize fixes that address the top 20% of issues causing 80% of complaints. For example, a B2B SaaS that reviewed 250 tickets found three UX problems driving 68% of escalations, then increased retention by 15% after targeted fixes—letting them scale with fewer support hires and steadier unit economics.

Validating Customer Demand and Feedback (for scaling your startup)

Run lightweight experiments: launch a landing page with pre-orders, run $1,000–$5,000 of targeted ads, or offer a beta to 100–300 users to measure conversion, engagement, and willingness to pay. Track early signals—5–10% paid-conversion from qualified traffic, a 20%+ trial-to-paid conversion in SaaS, or repeat purchase within 30 days for DTC—as proof points before you expand acquisition spend or add features.

Dive deeper by measuring retention cohorts, NPS, and unit economics: calculate CAC, LTV, and CAC payback (aim for LTV:CAC >3 and CAC payback under 12 months for scalable SaaS models). Run A/B tests on pricing and onboarding with sample sizes above 100 per variant to reach statistical significance, and use qualitative follow-ups to understand why users churn or convert. If paid tests show acceptable CAC and early cohorts retain, scale acquisition; if not, iterate product-market fit until cohorts improve, because solid demand validation prevents scaling into wasted spend and operational strain.

Creating a Framework for Growth — scaling your startup with stability

Map your operating model to measurable targets: aim for LTV:CAC >3, gross margins above 50% for SaaS, and maintain 12–18 months of runway as you pursue 20–50% annual revenue growth; tie every hire and product bet to a clear KPI and run quarterly health checks so you avoid the common pitfall of scaling too fast without operational resilience.

Designing Scalable Operations — scaling your startup

Standardize repeatable workflows with documented SOPs, reduce manual touchpoints by automating 40–60% of onboarding tasks using tools like Zapier or CI/CD pipelines, and cap spans of control around 1:8 managers to preserve decision speed; track cycle time, MTTR, and feature lead time so you can scale headcount only when throughput metrics warrant it.

Financial Systems That Support Expansion — scaling your startup

Implement a monthly close, rolling 13-week cash-flow forecast, and scenario-based budgets (best/likely/worst) tied to unit economics such as CAC payback <12 months and LTV:CAC >3; consider adding a fractional CFO or finance lead once ARR hits $2–5M to tighten forecasting, capital strategy, and fundraising cadence.

Automate revenue recognition, invoicing, and expense controls with tools like Xero/QuickBooks plus Fathom or Baremetrics for KPI dashboards; enforce a 5-day close, monitor burn rate and runway weekly, and run sensitivity analyses showing how small changes affect survival—for example, with ARPU $100 and monthly churn 5%, LTV ≈ $2,000, dropping churn to 4% raises LTV to $2,500, a 25% lift that materially improves your LTV:CAC and hiring capacity.

Funding Your Vision: Beyond Bootstrapping — Scaling Your Startup

You should size rounds to provide 18–24 months of runway and hit measurable milestones—product-market fit, repeatable sales channels, and 2x year-over-year revenue growth often unlock higher valuations. Balance dilution and control by modeling scenarios where valuation uplifts justify equity sold, aiming to retain roughly 30–40% founder stake through Series A while executing on metrics that prove your ability to scale your startup.

Navigating the Venture Capital Landscape for Scaling Your Startup

You should prioritize VCs that specialize in your stage and sector; seed checks typically range $1M–$5M while Series A rounds commonly fall between $8M–$25M. Expect term-sheet elements—15–30% ownership targets, liquidation preferences, anti-dilution clauses, and board seats—to shape governance. Use concrete metrics like ARR growth, LTV/CAC, and net retention to negotiate valuation and control as you scale your startup.

Tapping into Alternative Funding Sources for Scaling Your Startup

You can leverage equity crowdfunding, revenue-based financing, strategic corporate partnerships, and government grants to fund growth without immediate heavy dilution. Product-led crowdfunding proved viable for Oculus ($2.4M on Kickstarter) and Pebble (>$10M), while platforms like Wefunder and SeedInvest handle equity rounds. Match the funding type to your unit economics and timing to support sustainable scaling your startup.

If you choose revenue-based financing, you’ll typically repay 1–10% of monthly revenue until a cap around 1.5–3x the advance, preserving equity but tightening cashflow; equity crowdfunding rounds often range $250k–$5M and require strong marketing; SBIR/STTR grants can fund R&D with Phase II awards often exceeding $1M but involve a 6–12 month application cycle—use these timelines to sequence non-dilutive and dilutive options that support steady growth.

Building a Cohesive and Capable Team

As you scale your startup, keep management spans tight — target one manager per 6–8 individual contributors — and cap annual voluntary turnover under 10%. Set 90‑day onboarding ramps with clear OKRs tied to customer activation and unit economics, hire T‑shaped candidates, and allocate 10–15% of payroll to training and product experimentation. Run quarterly org‑health surveys and immediate 30–60 day action plans to balance speed with stability.

Strategies for Hiring the Right Talent — scaling your startup

Build role‑specific scorecards detailing outcomes, skills, and a 60‑day success plan; use structured interviews with a panel of three and 4–6 behavioral plus task‑based probes. Favor paid 1–2 week trial projects for senior hires, aim for one senior per 3–4 juniors to scale mentorship, and prioritize referrals plus targeted sourcing on GitHub, industry meetups, and niche job boards to cut time‑to‑hire by ~40%.

Fostering a Culture of Alignment and Purpose — scaling your startup

Publish a one‑page mission and three company priorities each quarter, cascade OKRs to teams, and hold a 30‑minute weekly all‑hands that ties wins to key metrics. Display real‑time dashboards for revenue, retention and top‑funnel KPIs, run monthly AMAs, and run micro‑recognition programs so every person sees how their work moves the needle and stays aligned during growth.

Dive deeper with onboarding rituals: a customer‑shadowing day, a 90‑day mentorship pairing, and a ‘why’ workshop where new hires rewrite the mission in their own words. Run two‑week cross‑functional mission sprints focused on one KPI, measure alignment via a 10‑question pulse survey, and require leaders to spend at least 20% of time on cross‑team coaching to sustain purpose and reduce misalignment as you scale your startup.

Smart Growth Strategies: Think Small to Grow Big — scaling your startup

Adopt a small-batch expansion model: pilot in one market, measure unit economics, then replicate. You should target a CAC payback under 12 months and an LTV/CAC ratio above 3 before broad rollout. Use compact cross-functional teams (3–7 people) to iterate product-market fit locally, and freeze further geographic moves until churn, conversion, and support costs stabilize. This prevents the common collapse from scaling too fast without a stable foundation.

Testing New Markets and Products Incrementally — scaling your startup

Run micro-pilots in 1–3 representative cities or customer segments for 6–12 weeks, exposing only 5–15% of your traffic to the new variant. Track primary metrics—conversion lift, CAC, churn—and require statistically meaningful thresholds (e.g., 95% confidence, ≥10% lift) before wider roll-out. Use A/B tests, cohort analysis, and local qualitative feedback to refine pricing, messaging, and onboarding before you scale operations or commit significant marketing spend.

Lessons from Successful Scale-Up Companies — scaling your startup

Airbnb, Dropbox, and Stripe illustrate repeatable playbooks: dominate a few initial markets, optimize a single acquisition funnel, then replicate. Dropbox’s referral program produced roughly a 60% signup uplift early on, while Airbnb focused supply-demand balance city-by-city before national growth. You should codify what worked in one market into playbooks—acquisition channels, onboarding flows, and local ops—so execution is consistent as you expand.

Translate those lessons into concrete actions: document a market playbook template, hire 1–2 local leads to own launch execution, automate onboarding to reduce support load by 30–50%, and set hard go/no-go metrics (CAC, LTV, churn, support cost per user). Run post-mortems after each pilot, lock successful pricing/packaging, then scale marketing spend by 2–3x only when unit economics hold steady.

The Metrics that Matter: Data-Driven Decisions

Track leading indicators like activation rate, conversion funnel, CAC, LTV, churn, and MRR growth so you can balance speed and stability while scaling your startup; aim for LTV:CAC ≥3:1, monthly churn under 5% for SaaS, and early MRR growth of 10%+ month-over-month. Use cohort dashboards to spot regressions and validate bets—see practical frameworks in Scaling Your Startup Sustainably: A Guide to Growth Without Compromise.

Key Performance Indicators for Startups — scaling your startup

Focus on unit economics: CAC, LTV, payback period, gross margin, and churn; monitor MRR/ARR, net dollar retention (NDR), conversion rates, and cohorts at day 7/30/90. Benchmarks to chase include LTV:CAC ≥3:1, payback <12 months, NDR >100% for net-positive expansion, and gross margins above 60% for SaaS—use these KPIs to prioritize product, sales, and retention investments as you scale your startup.

Using Analytics to Pivot and Optimize — scaling your startup

Run cohort and funnel analysis to find where users drop off—if a new cohort shows a 40% drop after onboarding, run targeted A/B tests on onboarding flows to lift activation by 10–20% and measure downstream LTV impact. Combine qualitative feedback with quantitative signals to decide whether to iterate or pivot growth channels quickly while preserving unit economics.

Instrument events with tools like Amplitude, Mixpanel, or GA4, define hypotheses, and compute sample sizes for 95% confidence with a minimum detectable effect of 5–10%; prioritize experiments by expected ROI and run until statistically significant or until pre-set time/safety limits. Segment results by acquisition channel, geography, and device to avoid misleading averages, and maintain rollback plans and guardrails so experiments scale safely as you continue scaling your startup.

Summing up: scaling your startup successfully

Drawing together, you must align product-market fit, team capacity, and systems so scaling your startup proceeds without collapse; prioritize measured experiments, cash runway management, and operational discipline so your growth is sustainable. Keep feedback loops tight as you pursue scaling your startup, delegate authority, and standardize processes to preserve quality and speed. Use metrics that track stability and velocity to guide each expansion step confidently.